By David South, Development Challenges, South-South Solutions

Many people are aware of the significant role played in global development by remittance payments from migrant workers working in the wealthy North to the global South. But they may not be aware of the significant sums migrant workers have saved in bank accounts in these wealthy countries. Across the global South, efforts are underway to lure these sums back to home countries to boost development efforts.

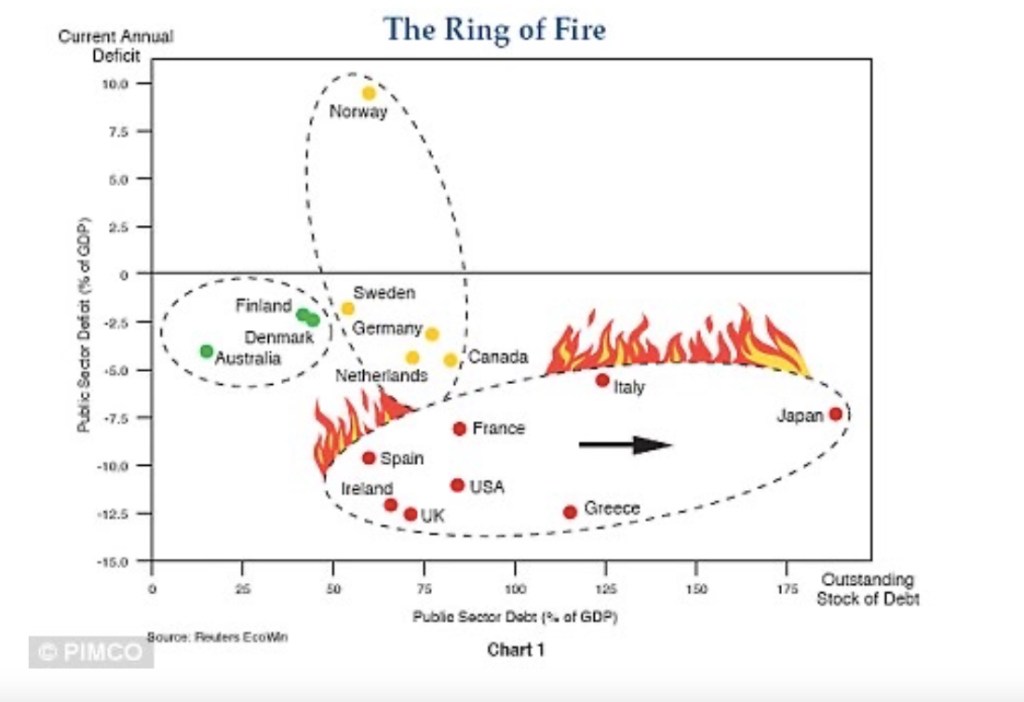

As the hard-earned money migrant workers save sits in bank accounts in wealthy Western countries earning very low interest rates – a consequence of the current global economic crisis – so-called “Diaspora Bonds” seek to offer a way to earn good interest returns and help build up home countries at the same time.

The money can help developing countries build facilities they need but cannot afford: roads, bridges, railways, water supplies, power, sewerage, street lighting. It is a way to bypass dependence on foreign aid and borrowing from aid agencies or the general marketplace.

US $501 billion in remittance payments was sent in 2011, of which US $372 billion went to developing countries, involving some 192 million migrants or 3 per cent of the world’s population (World Bank). On top of this, migrants from developing countries have saved an estimated US $400 billion – and these funds are being targeted by those selling diaspora bonds (The Economist).

The idea is being promoted by the World Bank and draws on the successful experiences with bonds for Israel and India. Both countries have long histories of turning to diaspora communities to raise funds through bonds.

The bonds work by playing on patriotism and the genuine desire of migrants to want to see conditions improve back home. As the thinking goes, patriotic investors are more likely to be patient. This is critical because many countries cannot offer rapid profits and a quick pay off – something sought by short-term investors obsessed with the ups and downs of the stock market. They are also sterner investors, less likely to run away when the going gets tough. Their local knowledge means they will not panic and pull their investments when bad news hits the headlines. And probably best of all, they don’t mind if the local currency declines in value – that just means they can pick up a local house on the cheap or buy a business for even less money.

One business working in this area is Homestrings (homestrings.com): Motto “Come make a difference.” An Internet platform offering diaspora bonds, it is run by founder and chief executive officer Eric-Vincent Guichard. An American born to a Guinean father and American mother, he spent 20 years growing up in rural Guinea and knows the country well. He also heads up GRAVITAS Capital Advisors, Inc. (gravitascapital.com), founded in 1996, which advises governments on how to manage their assets. A graduate of HarvardBusinessSchool and a former World Bank scholar, he is based in Washington, D.C.

According to its website, Homestrings works like this: “It all starts with your ability to scan through a catalog of projects, funds and public-private partnership opportunities that focus on regions you come from or that you care deeply about. Each of these projects and/or funds is detailed in a Fact Sheet that is set up to help you do the due diligence needed to make an investment decision. Then, Homestrings directs your investment into the selected project or fund, with the help of our administrator.”

Investments are monitored on a monthly or quarterly basis and are selected for their socio-economic impact and investment profitability.

The website has a personal “Dashboard” that allows investors to use the site to vote for or against investments and make comments. And Homestrings will promote the investments that receive the most support and positive comments.

To make an investment, a potential investor selects a fund or project that matches their interest. They read the Fact Sheet and choose. The funds are then passed on to the investment bond and an interest percentage or dividend is paid at regular intervals. Investors can keep track of the investment through the personal Dashboard on the website.

Fact Sheets are organized by geographical region, industry focus, and development theme. Investments “cover infrastructure, health care, education, transportation, and small and medium sized enterprise finance – all critical areas of economic growth.”

The Homestrings Catalog of investments includes the governments of Kenya, Senegal, Ghana, Nigeria and also AFREN PLC, which is looking to finance oil and gas exploration off the coast of Nigeria.

Dramatic improvements in global communications in the past five years have also made it much easier for everyone involved to stay in touch and for bond promoters to identify and target potential customers.

The World Bank is currently advising countries on how to run diaspora bond schemes. Kenya, Nigeria and the Philippines have schemes in the works, according to The Economist.

Ethiopia has announced the “Renaissance Dam Bond” (http://grandmillenniumdam.net/). Proceeds will be used to fund the construction of the Grand Renaissance Dam, the largest hydroelectric power plant in Africa, able to generate 5,250 megawatts. Ethiopia tried a similar scheme before with the Millennium Corporate Bond to raise funds for the Ethiopian Electric Power Corporation (EEPCO). This did not entirely meet expectations and sales were slow. Reasons given for this included a perception that EEPCO could not meet payment expectations when the hydroelectric power plant was operating. There was also a lack of trust in the government and its financial stability and the overall political risks.

The second attempt at a bond is believed to better thought through. It comes with an aggressive marketing and awareness-raising campaign aimed at the diaspora, and it starts at US $50, making it more affordable for more people. It can be used as collateral in Ethiopia – an advantage for those wanting to do business back in the home country.

For potential investors, it is worth remembering that bonds are debts that are rewarded with regular interest payments and paid back at the end of the bond term. They are not risk-free and the risk can lie either in the sovereign solvency of the country or in the investment.

The secret to a successful bond issue is to keep up good relations with the diaspora; countries that are too oppressive could find themselves short of people willing to take up the offer.

Published: October 2012

Resources

1) Remittance Payments Worldwide: A website by the World Bank tracking remittance prices worldwide. Website:http://remittanceprices.worldbank.org/About-Us

2) The World Bank blog on diaspora bonds. Website:http://blogs.worldbank.org/category/tags/diaspora-bond

3) A critical perspective on diaspora bonds at Africa Unchained. Website:http://africaunchained.blogspot.co.uk/2012/03/are-diaspora-bonds-worth-risk.html

Development Challenges, South-South Solutions was launched as an e-newsletter in 2006 by UNDP’s South-South Cooperation Unit (now the United Nations Office for South-South Cooperation) based in New York, USA. It led on profiling the rise of the global South as an economic powerhouse and was one of the first regular publications to champion the global South’s innovators, entrepreneurs, and pioneers. It tracked the key trends that are now so profoundly reshaping how development is seen and done. This includes the rapid take-up of mobile phones and information technology in the global South (as profiled in the first issue of magazine Southern Innovator), the move to becoming a majority urban world, a growing global innovator culture, and the plethora of solutions being developed in the global South to tackle its problems and improve living conditions and boost human development. The success of the e-newsletter led to the launch of the magazine Southern Innovator.

This work is licensed under a

Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License.

ORCID iD: https://orcid.org/0000-0001-5311-1052.

© David South Consulting 2022

You must be logged in to post a comment.