By David South, Development Challenges, South-South Solutions

The West African nation of Ghana’s funeral economy is attracting innovation and grabbing attention outside the country. The nation’s elaborate – but expensive – funeral rituals provide craftsmen with a good income. And new products are being introduced to handle the financial consequences of this unavoidable fact of life.

As Africa undergoes the biggest shift from rural to urban in its history, the continent is experiencing a technology boom, mainly led by the mobile phone. Mobile phones have become important transactional tools in daily life, enabling people to communicate and to do business, thanks to micropayments and prepay. Interwoven in these twin phenomena of greater urbanization and the mobile phone economy is a rising and growing middle class population with spare cash to spend on more than just the basics of survival. And all of this is throwing up new economies and new products to sell to these middle class customers.

It is in this context that Ghana’s flamboyant and vibrant funeral ceremonies have become an economy unto themselves.

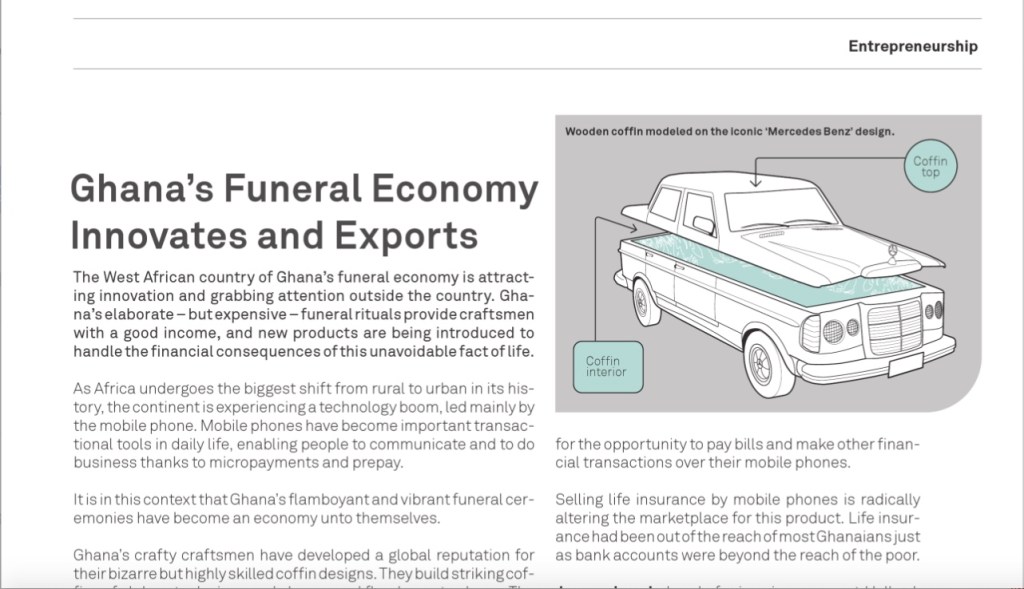

Ghana’s crafty craftsmen have developed a global reputation for their bizarre but highly skilled coffin designs. They build striking coffins of elaborate designs and shapes and flamboyant colours. The coffins usually take on the shape of an aspect of the deceased’s former profession or vocation. For example, a pilot gets buried in a mock-up of the plane they flew, or a farmer is buried in his main crop, like a giant corn cob.

It is proof the creative economy works and adds value to existing products and services. What were just simple coffins for a utilitarian task (burying the dead) becomes an elaborate work of art and transforms burial into a grander experience.

One of the most popular designs is the now-ubiquitous and much-coveted mobile phone: Africa’s great electronic connector. And it is the mobile phone that is allowing people to buy life insurance to be able to pay for the coffins and elaborate funerals.

Mobile money is a dynamic and fast-growing industry that is firmly established in the global South. Some are forecasting the market in mobile payments will reach US $60 billion by 2015.

A range of companies are now offering life insurance policies that can be paid for in small “micropayments” by mobile phone. This is an important service for people who may not have a formal bank account and who can be devastated by the costs of a family member’s funeral.

The two companies pioneering this “micro-insurance” service are Hollard Insurance (http://www.hollard.co.za) and Mobile Financial Services Africa (http://mfsafrica.com). Both are offering funeral insurance by mobile phones. Working with MTN – Africa’s largest mobile phone group (www.mtn.com.gh) – they are launching the mi-Life insurance product, sold for between US 0.80 cents and US $4 for a month’s coverage.

MTN pioneered its Mobile Money service in 2009. Out of 9 million MTN mobile phone subscribers in Ghana, 1.8 million have signed up for the opportunity to pay bills and make other financial transactions over their mobile phones.

Selling life insurance by mobile phones is radically altering the marketplace for this product. Life insurance had been out of the scope of most Ghanaians just as bank accounts were beyond the reach of the poor.

Jeremy Leach, head of micro-insurance at Hollard, told AllWestAfrica (allwestafrica.com), that 55 percent of Ghanaians say they can’t afford life insurance. “In terms of affordability, we’ve tried to address that.”

MTN Mobile Money Ghana’s general manager, Bruno Akpaka, told the Financial Times mi-Life is 50 to 70 per cent cheaper than comparable policies.

Subscribers sign up by using their mobile PIN (personal identification number) at a local kiosk, or send a short message service (SMS) on their handset. Once signed up, a monthly premium is taken from their account. When it runs out, they top it up at the kiosk again.

It currently offers basic funeral cover: a lump sum to the family when the main income earner dies. This money is used towards the costs of expensive funerals. Other products in the pipeline include insurance for school fees.

For the coffin craftsmen, the fast-growing economy of African online shopping is helping with sales. The elaborate craft coffins can be bought online from various platforms including eShopAfrica.com, which promises to sell “fair trade direct from Africa.” Its dedicated Ghana coffin pages (www.eshopafrica.com/acatalog/Ga_Coffins.html) advertise small coffins that take a month to make, and larger ones can take up to three months to build. Prices advertised on the eShop site range from US $1,500 for a full-sized, six-foot coffin, to US $175 for a “desk top chest.”

Designs range from a mobile phone to a Ferrari race car to a computer mouse. But it is not just the resting places for the deceased that are on sale. The cabinet- and coffin-making skills are also turned to making a wide range of storage cabinets in bright colours and imaginative shapes, from a football to a red pepper and a beer-bottle shaped drinks cabinet.

The global attention for the craftsman has been impressive. They are lauded by fine art collectors around the world and have been shown in galleries such as London’s Jack Bell Gallery (www.jackbellgallery.com/paajo.html). The legendary coffin artist Paa Joe is one of the most featured in gallery shows.

Published: April 2011

Resources

1) Shop Africa 53: An online shopping website allowing independent traders to vend their products to the rest of Africa and the world. Website: www.shopafrica53.com

3) Going into Darkness: Fantastic Coffins from Africa by Thierry Secretan, details the culture and the craftsmen, behind the iconic coffins. Website:www.amazon.com/exec/obidos/ASIN/0500278393/cordelinetwebstu%22

4) Creative Economy Programme: The creative economy is an emerging concept dealing with the interface between creativity, culture, economics and technology in a contemporary world dominated by images, sounds, texts and symbols. Website:www.unctad.org/Templates/StartPage.asp?intItemID=4577&lang=1

Bangladesh Coffin-Maker Offers an Ethical Ending

https://davidsouthconsulting.org/2022/10/20/bangladesh-coffin-maker-offers-an-ethical-ending/

Development Challenges, South-South Solutions was launched as an e-newsletter in 2006 by UNDP’s South-South Cooperation Unit (now the United Nations Office for South-South Cooperation) based in New York, USA. It led on profiling the rise of the global South as an economic powerhouse and was one of the first regular publications to champion the global South’s innovators, entrepreneurs, and pioneers. It tracked the key trends that are now so profoundly reshaping how development is seen and done. This includes the rapid take-up of mobile phones and information technology in the global South (as profiled in the first issue of magazine Southern Innovator), the move to becoming a majority urban world, a growing global innovator culture, and the plethora of solutions being developed in the global South to tackle its problems and improve living conditions and boost human development. The success of the e-newsletter led to the launch of the magazine Southern Innovator.

This work is licensed under a

Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License.

ORCID iD: https://orcid.org/0000-0001-5311-1052.

© David South Consulting 2023

You must be logged in to post a comment.