By David South, Development Challenges, South-South Solutions

The global downturn and economic crisis is now into its third year. Economic growth has dropped across the South, as the knock-on effect of shrinking credit and slowing global markets took its toll.

One solution to re-starting growth and building up domestic industries is to target local products at the existing middle class, which in turn grows the middle class by creating better paying jobs.

Globally, 2009 saw 70 million people join the emerging-market middle class, with incomes between $6,000 and $30,000. And 1 billion people are expected to join the middle class by 2020. It has been called “the story of the decade,” by Goldman Sachs’s chief economist Jim O’Neill, who forecasts their global spending power will outstrip the developed world in two decades.

Indonesia’s middle class first began to grow in the 1980s. But rising prosperity took a heavy blow with the Asian economic crisis of the late 1990s, when the currency was devalued, pitching millions of people back into poverty.

Even so, Indonesia’s middle class is estimated to be between 35 and 40 million people (out of a population of 230 million) and they pay out roughly US $750-1000 on monthly household spending.

They are a mix of people, including professionals in management, banking, accounts, specialized law, bio-technology, engineering and other areas – all skills needed to run the market economy.

Like members of the middle class around the world, increasingly affluent Indonesians forge their identity through consumerism and lifestyle. This desire for goods and services represents a huge business opportunity. Often, this is captured by large multinational companies with long experience of selling branded goods and services.

Indonesia, however, is having great success growing its middle class despite the global economic downturn by building up the domestic market. Millie Stephanie, the director of Indonesia Tatler Magazine, told the BBC that two-thirds of the country’s economy runs on domestic consumption.

New middle class housing is springing up around the capital Jakarta. Home ownership for many, unthinkable a decade go, is now possible as banks make more loans possible. This in turn feeds into more consumption.

By turning to local products – something the Indonesian government is encouraging by increasing its own spending on local goods and services in 2010 by US $21.32 billion, according to Industry Minister MS Hidayat – a cycle is created where middle class wealth creates middle class jobs in local companies.

The department store chain of Matahari (http://www.matahari.co.id/) – the largest local department store in Indonesia – is a good example. Eighty percent of the goods it sells are made in Indonesia. The store targets the middle class with products like jeans that Indonesians can afford. And this strategy has helped Indonesia to get through the downturn.

According to Widia Augustinia, who runs the PT Inti Garmindo Persada jeans factory, the company was able to triple production despite the downturn.

“In the last few years we kept getting calls from our clients saying they had sold all our jeans and they wanted more, so we had to expand our business and had to hire more people,” she told the BBC.

One of the factory’s workers, 37-year-old Miriam, has seen her salary increase annually over the last four years while she has worked in the factory. The increasing wealth means she can now educate her children and buy a TV and a motorcycle.

This matters when half the population are living on less than two dollars a day. This recycling of middle class wealth into the Indonesian economy is making more workers become part of the emerging middle class with the jobs created.

In Africa, the Aureos Advisers (http://www.aureos.com/) private equity firm specializes in investing in African small and medium size enterprises, and is having great success with it despite the downturn. Its niche is finding and investing in companies that sell quality local products.

Run by Sri Lankan-born Sev Vettivetpillai, it raised US $150 million in 2009 to invest in Africa, much of it from pension funds.

“That’s a large sum of money in a market where raising capital is tough,” he told The Guardian newspaper.

Leverage was a game when cheap debt was around,” he says of the old private equity market that went up in flames in 2008. “Today a large chunk of growth is in emerging markets and we have proved you can invest responsibly in these markets and achieve attractive returns while paying attention to building sustainable businesses.”

And the faith in small and medium-sized African businesses has been paying off despite the economic turmoil: since most of the companies have little debt, they have not suffered in the downturn. And since many do not export much to Europe or the United States, they have not suffered from the consumer slump.

“When markets crashed 60 percent, good management teams were making sure they had cash, not much debt,” said Vettivetpillai. “Most banks don’t lend to these SMEs. And that has saved a number of those businesses. So we had an upward lift in earning growth in 2008 when many people showed a drop.”

Published: March 2010

Resources

1) A paper from the University of Hawaii by Mohammad Hasan Ansori on Indonesia’s middle class. Website: http://tinyurl.com/ylq7nf6

2) The red dot logo stands for belonging to the best in design and business. The red dot is an internationally recognised quality label for excellent design that is aimed at all those who would like to improve their business activities with the help of design. Website: http://www.red-dot.de/

3) A video on designing for the middle class in emerging markets. Website: http://www.youtube.com/watch?v=-JLO1RuQIPw&feature=related

4) Product design strategies for emerging markets. Website: http://www.appliancemagazine.com/editorial.php?article=1633&zone=1&first=1

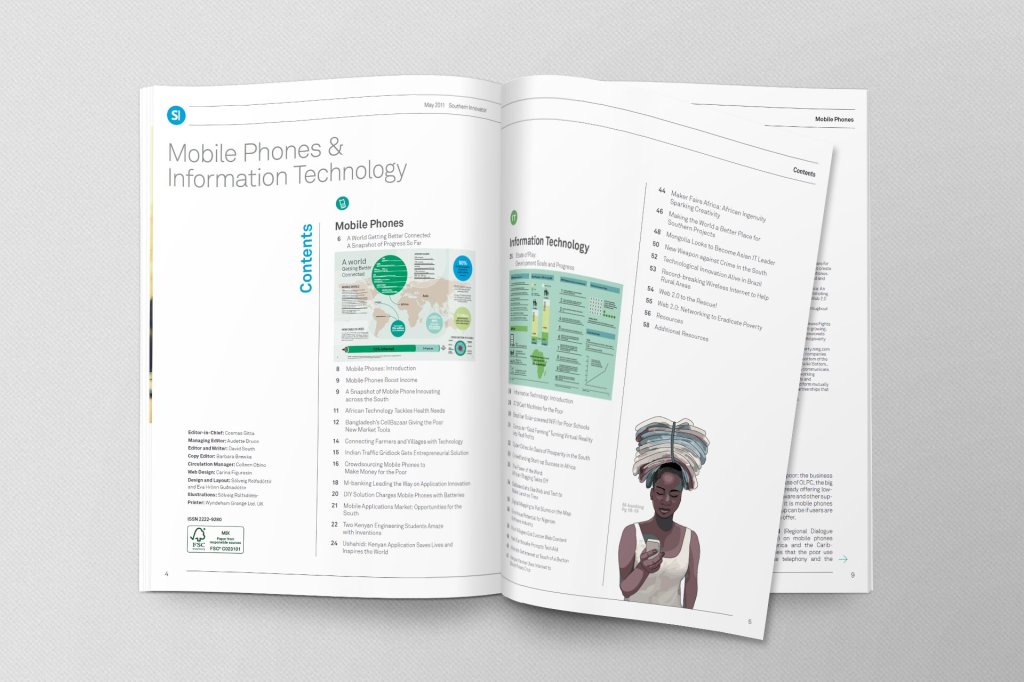

Development Challenges, South-South Solutions was launched as an e-newsletter in 2006 by UNDP’s South-South Cooperation Unit (now the United Nations Office for South-South Cooperation) based in New York, USA. It led on profiling the rise of the global South as an economic powerhouse and was one of the first regular publications to champion the global South’s innovators, entrepreneurs, and pioneers. It tracked the key trends that are now so profoundly reshaping how development is seen and done. This includes the rapid take-up of mobile phones and information technology in the global South (as profiled in the first issue of magazine Southern Innovator), the move to becoming a majority urban world, a growing global innovator culture, and the plethora of solutions being developed in the global South to tackle its problems and improve living conditions and boost human development. The success of the e-newsletter led to the launch of the magazine Southern Innovator.

This work is licensed under a

Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License.

ORCID iD: https://orcid.org/0000-0001-5311-1052.

© David South Consulting 2023

You must be logged in to post a comment.