By David South, Development Challenges, South-South Solutions

Africa’s paradox is that it is home to the greatest share of the world’s unexploited resources, yet has some of the world’s lowest per capita incomes. History has shown that exploiting the continent’s resources alone for export markets does little to improve incomes and living conditions in Africa, which in turn does nothing to improve human development. The key to resolving this paradox is made-in-Africa jobs, in particular high-value jobs that make products.

Africa still mostly makes its income from exporting raw commodities, from minerals to fuel to food. In the 1990s, Asian countries exported five times more manufactured goods, as share of GDP, than sub-Saharan Africa. Things changed in the 2000s. African manufactured output has roughly doubled over the last 10 years. And those goods are going more to the emerging economies than to the traditional powers (African Economic Outlook).

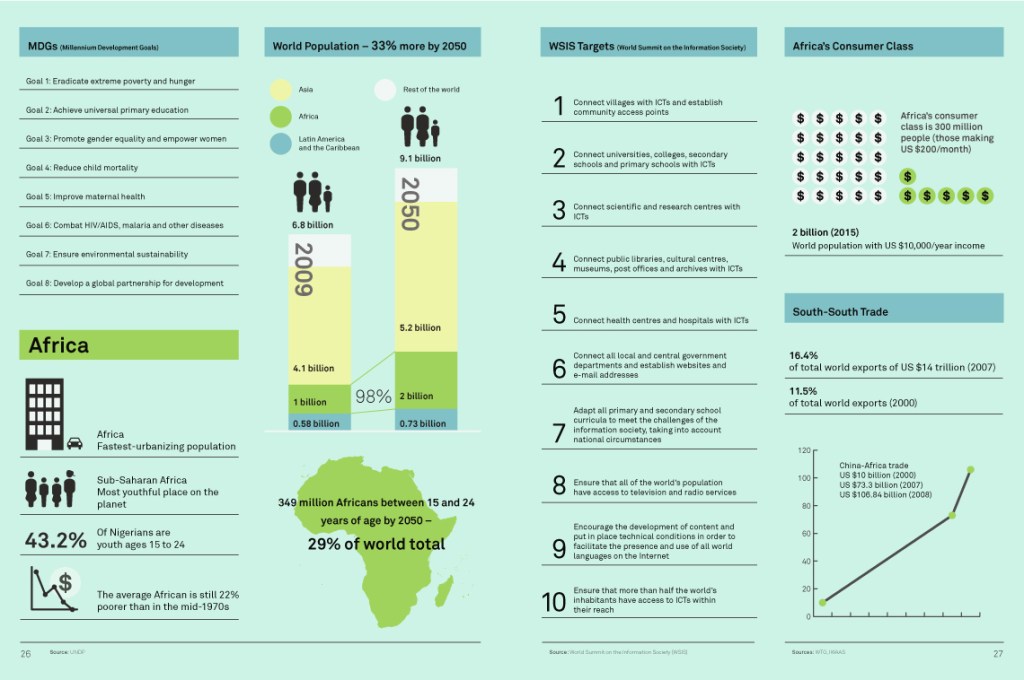

African Economic Outlook points out that by 2009 “trade between African countries and emerging powers equalled that between Africa and its traditional partners.”

“South-based manufacturing enhances the welfare of African consumers via prices and functionality,” the report says.

“For instance, generic Indian pharmaceuticals are cheaper than brands from traditional partners.”

Small and medium enterprises (SMEs) have been identified as a key part of Africa’s future prosperity and key to its ability to reduce poverty and achieve development objectives like the Millennium Development Goals (MDGs) (www.un.org/millenniumgoals).

The sector is large but its economic power is inefficiently used. Telling the Wall Street Journal, Mthuli Ncube, chief economist at the African Development Bank Group, estimated one-quarter of Africa’s gross domestic product — about US $450 billion — comes from 65 million small and medium-sized enterprises.

Manufacturing has been difficult to measure because so many businesses are just tiny cottage industries.

Obstacles to growth include poor infrastructure, unreliable power supplies, unscaleable business models, low quality standards and poor quality branding and design.

Access to funding is often weak and fragmented and many programmes run by international donors and banks targeting SMEs are uncoordinated and duplicate resources. The global economic crisis has not made these factors any easier.

But things are changing in many areas. The booming technology, consumer goods and resource sectors offer hope for a manufacturing renaissance.

There are examples from Africa defying the sceptics and showing it is possible to expand and export manufactured, finished goods that meet international standards.

What they have in common is a sophisticated product offering and an ability to meet international export standards. They also have overcome obstacles that scare away more timid international rivals.

Nigerian shoe and garment maker Fut Conceptus (www.futconceptus.com) has been taking raw Nigerian leather that was once just sent overseas for export, and instead is turning out high-quality shoes and bags made in Nigerian factories. These shoes – made in African, Spanish and Italian styles – meet international standards and are exported aroundAfrica. It has also established operations in Spain and the United Kingdom.

Started in 2008, the company got off to a good start by seeking out the best expertise to train its staff. Shoe-making experts fromSpainwere brought in to do the training. The company also imported top-quality machinery fromItalyandSpainto make sure its operations were modern and efficient.

These first, smart moves have meant the company is able to run an efficient and high-skilled operation inNigeriawhile also making its products to international standards. This is critical for a start-up business: the better the quality of the product in the beginning, the better the chance for accessing lucrative export markets. And the better and more efficient the manufacturing processes, the better chance a company will have meeting increasing demand and tight deadlines. It is one thing to make the best shoe in the world, but if you cannot deliver the quantity required for orders, then your reputation will be damaged.

Fut Conceptus is able to produce 22,000 pairs of sandals and 10,000 pairs of safety boots a day, according to its website.

Fut Conceptus Manufacturing Nigeria Ltd. also found a way to thrive in the country’s difficult and erratic conditions. To deal with the unreliable power supply, they run four electric generators. This costs them US $500 a day in fuel. This power problem scares off multinational companies, leaving the market open for Fut Conceptus. The company has been able to use this first-mover advantage to build its brand acrossWest Africa. It currently makes men’s moccasins, slippers, law enforcement footwear, safety footwear, and ladies’ sandals.

Founder Olumide Wole-Madariola is proud of the achievement. “Nobody was ready for what we were doing… Nobody was ready for ‘Made inNigeria,’” he said.

South African sauce maker Primolitos (www.primolitos.com) has become one of the few African companies able to meet international standards for food exports. It makes a vast range of products (http://www.primolitos.com/index.php?option=com_content&view=article&id=10&Itemid=12), from juices to sauces, spices, pickles, soups and baked goods.

The company has been around for over a decade and sells 2,000 products. It has also set-up a sister division to specialise in liquid and powdered food sachets. The company also has a clear “Quality Policy”, championing collective decision-making between management and staff, delivering “quality and safe consumer products”, and a system to quickly respond to consumer complaints and recall substandard products. All ingredients for building trust in a business.

It also has an ISO 20 0002 (www.iso.org/iso/home.html) accredited factory, complete with three testing labs, a training room, test kitchen, care centre for employees’ children, a wellness centre, laundry, high-tech water filtration and purification systems and the latest in hygiene and manufacturing processes. All of this a clear example of the commitment required to build a quality company that can export.

Over at Good African Coffee, Ugandan entrepreneur Andrew Rugasira is pioneering new ways to process coffee inAfrica. He set upUganda’s first enterprise to make instant coffee two years ago. This is a radical departure from the old practice of exporting the coffee beans to Europe for processing into instant coffee, which would then be exported back toAfrica.

“For decades, Africans have produced what they do not consume and consumed what they do not produce,” Rugasira told the Wall Street Journal.

The company has developed unique distribution arrangements for its instant coffee. A recent deal included providing coffee for an American network of 12,000 churches.

The company’s products are cleverly designed and packaged and are sold in distinct colour-coordinated packets. The company also passionately champions “trade not aid” as the long-term solution toAfrica’s economic growth (http://www.goodafrican.com/index.php/our-story/trade-not-aid.html).

On the African islandof Madagascar, a company is trying to reverse the practice of exporting Africa’s cocoa beans for manufacturing into chocolate products. The Madecasse Chocolate LLC. (http://madecasse.com) is a collaboration between American entrepreneur Tim McCollum and Madagascan chocolatier Shahin Cassam Chenai. The company is making a range of chocolate and vanilla products for US supermarkets.

“IfAfricacould sell the world chocolate…it wouldn’t solve all the continent’s problems, but it could make a big dent,” McCollum told the Wall Street Journal.

Africais believed to produce 60 to 70 percent of the world’s cacao supply. Less than one percent is made inAfricaand most is made into chocolate outside the continent.

Madecasse’s high-quality chocolate bars sell in the USfor US $6 each. Their market niche is to make “a single-origin chocolate, made entirely in Madagascar, which rivals the flavour of the best European chocolates”, according to its website. Flavours (http://store.madecasse.com) include pink pepper and citrus, cinnamon and sakay (a type of Madagascan hot pepper sauce), exotic pepper, sea salt and nibs, Arabica coffee, and baking chocolate. They also sell the world-famous Madagascan vanilla beans and extract. All are sold in colourful and well-designed packaging and sold on their website.

Chenai is a self-taught chocolate maker and works with a local team to refine the Madécasse chocolate.

“Connoisseurs knowMadagascarproduces some of the best cocoa in the world,” maintains Chenai. “My passion is to prove we can produce some of the best chocolate in the world.”

Published: December 2011

Resources

1) SME Toolkit South Africa: A website packed with resources and support for anyone starting a small business in Africa. Website: http://southafrica.smetoolkit.org/sa/en

2) African Guarantee Fund for Small and Medium-sized Enterprises: The AGF provides guarantees and technical assistance to financial institutions in Africa with the objective of generating enhanced growth in the SME sector and increasing employment opportunities in the economy, particularly for youth. Website: www.afdb.org/en/topics-and-sectors/initiatives-partnerships/african-guarantee-fund-for-small-and-medium-sized-enterprises/

3) Small and Medium Enterprise Support, East Africa: A blog promoting events and support for SMEs in East Africa. Website: http://smeseastafrica.blogspot.com/

4) Integrating Developing Countries’ SMEs into Global Value Chains: A paper from UNCTAD (2010). Website:http://www.unctad.org/en/docs/diaeed20095_en.pdf

This work is licensed under a

Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License.

ORCID iD: https://orcid.org/0000-0001-5311-1052.

© David South Consulting 2023

You must be logged in to post a comment.