By David South, Development Challenges, South-South Solutions

Access to basic banking services for the poor is weak at the best of times. Many are openly discriminated against as a ‘bad risk’ by banks, and denied the sort of banking services middle and higher income people take for granted. Yet it is a myth that the poor do not have money or do not wish to save and invest for their future or for business.

The so-called Bottom of the Pyramid (BOP) – the four billion people around the world who live on less than US $2 a day – are being targeted by a wide range of businesses. Indian business consultant and professor CK Prahalad, the man who coined the term BOP, has gone so far as to claim this is a market potentially worth US $13 trillion, while the World Resources Institute puts it at US $5 trillion in its report, The Next 4 Billion.

And contrary to popular perception, the poor do have buying power, as has been documented by Massachusetts Institute of Technology (MIT) professors Abhijit Banerjee and Esther Duflo in their paper “The Economic Lives of the Poor”. Surveying 13 countries, they found those living on less than a dollar a day, the very poor, actually spent 1/3 of their household income on things other than food, including tobacco, alcohol, weddings, funerals, religious festivals, radios and TVs. The researchers also found that the poor increasingly used their spending power to seek out private sector options when the public sector failed to provide adequate services.

India, where 63 percent of the BoP market is rural and 304.11 million people are illiterate (Human Development Report), makes for a particularly tricky market to reach with bank machines: the average transaction is just 100 rupees (£1.25).

But a Madras-based company has come up with the Gramateller – a low-cost, blue-and-white bank machine custom-designed for the poor and illiterate. Vortex received funding of 2 million rupees (US $48,000) from an investment company, Aavishkar, that specializes in micro-venture capital — small sums for new business ideas. The advantage of micro-venture capital funding is its longer payback time: a young company does not get driven out of business by having to pay back the cash before the idea has been realized. Normally, venture capital helps a business to grow quickly but the venture capitalist wants to see an immediate profit on the investment.

Vortex’s chief executive officer, V.Vijay Babu, said: “The idea was conceived by Prof. Jhunjhunwala of IITM (Indian Institute of Technology Madras) in the course of an exploratory project focused on using ICT to deliver modern banking services to rural India.”

“It was found that branch-based banking is too expensive to be extended to remote rural locations where the volume and size of transactions are small. Using conventional ATMs (automatic teller machines) as a channel posed many difficulties because these ATMs were not built to operate in [illiterate] environments. Hence the need for developing an ATM specific to this context.”

Costing just a 10th as much to build as an ordinary cash machine, Gramateller has a fingerprint scanner for the illiterate, and is able to accept dirty and crumpled bank notes. Vortex came up with an ingenious solution to do this, said Babu: “Vortex developed a beltless dispenser design that in many ways mimics the way a human teller would pick and count notes.”

Vortex hopes to massively expand access to cash machines: at present, India has just 30,000 machines, or one for every 43,000 people (the US has a machine for every 1,000 people). These machines are being piloted with India’s biggest private bank, ICICI, and they have garnered interest from Indonesian banks as well.

“We are running pilots for two leading banks with about 10 ATMs,” said Babu. “Though it is still early, the initial response has been very encouraging – rural users find fingerprint authentication intuitive and simple and the ATM convenient and easy to use. A few users also gave feedback that our ATMs look less intimidating, maybe because it is placed in a non-air conditioned room with easy access and also is different in shape from a typical ATM.”

Furthermore the cash machines have taken a beating to see if they are robust enough for rural India: “The ATMs were tested for extended operating cycles under the harshest of environments that would prevail in the rural context — using soiled currencies, operating in non-air conditioned and dusty environments, subjecting the machine to typical fluctuations in line voltages and power outages. User-acceptance was tested by enlisting the participation of rural and semi-urban people to carry out test transactions.”

As for thieves getting their hands on the cash before the poor, Vortex maintains the machines will not become the victim of thieves: each machine will only carry a fifth of the money of city-dwelling bank machines.

Elsewhere in the South, a South African research and analysis company BMI-TechKnowledge (http://www.bmi-t.co.za/) in its latest report identifies a boom in banking services across Africa. In particular, South Africa, Botswana, Namibia, Angola, Mauritius, Tanzania, Kenya, Ghana, Nigeria, Egypt and Morocco – all have seen surges in profit and services as a result of improving banking regulations and political conditions. Maybe future markets for the Gramateller to reach Africa’s poor lie ahead?

Published: August 2008

Resources

- Unleashing India’s Innovation: Toward Sustainable and Inclusive Growth, a report by the World Bank.

Website: web.worldbank.org - xigi.net (pronounced ‘ziggy’ as in zeitgeist) is a space for making connections and gathering intelligence within the capital market that invests in good. It’s a social network, tool provider, and online platform for tracking the nature and amount of investment activity in this emerging market also referred to as blended value investing. xigi’s goal is to help this international emerging market to grow through market formation activities that guide and educate a growing wave of new money, while connecting it to the emergent entrepreneurs and deals on the internet.

Website: http://www.xigi.net/ - The new report Global Savings, Assets and Financial Inclusion by the Citi Foundation is packed with innovative approaches that are allowing the BoP (bottom of the pyramid) to use their income to build assets and more sustainable livelihoods.

Website: http://www.newamerica.net - NextBillion.net: Hosted by the World Resources Institute, it identifies sustainable business models that address the needs of the world’s poorest citizens.

Websites: http://www.nextbillion.net/ and World Resources Insitute

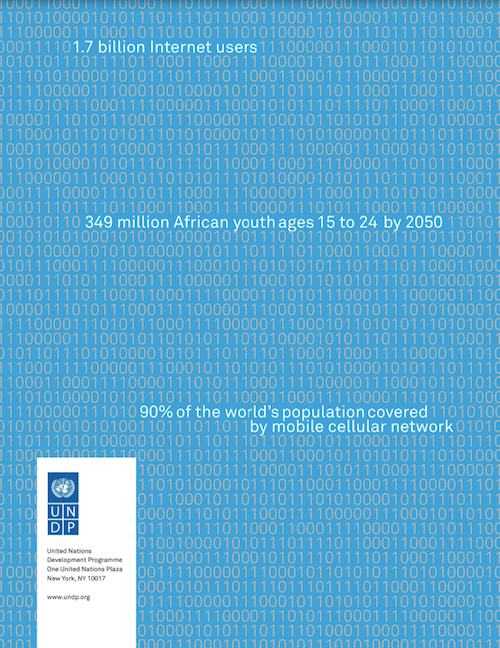

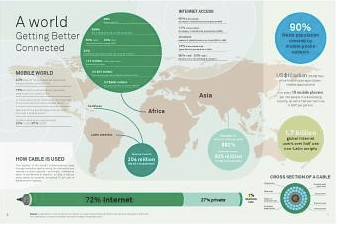

Development Challenges, South-South Solutions was launched as an e-newsletter in 2006 by UNDP’s South-South Cooperation Unit (now the United Nations Office for South-South Cooperation) based in New York, USA. It led on profiling the rise of the global South as an economic powerhouse and was one of the first regular publications to champion the global South’s innovators, entrepreneurs, and pioneers. It tracked the key trends that are now so profoundly reshaping how development is seen and done. This includes the rapid take-up of mobile phones and information technology in the global South (as profiled in the first issue of magazine Southern Innovator), the move to becoming a majority urban world, a growing global innovator culture, and the plethora of solutions being developed in the global South to tackle its problems and improve living conditions and boost human development. The success of the e-newsletter led to the launch of the magazine Southern Innovator.

This work is licensed under a

Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License.

ORCID iD: https://orcid.org/0000-0001-5311-1052.

© David South Consulting 2023

You must be logged in to post a comment.