By David South, Development Challenges, South-South Solutions

Inflation, environmental stresses and population and economic growth are testing the world’s food supply systems. There is a strong need to boost yields and improve the quality of food.

Between now and 2050 the world’s population will rise from 7 billion to 9 billion. Urban populations will probably double and incomes will rise. City dwellers tend to eat more meat and this will boost demand.

The UN’s Food and Agriculture Organization (FAO) reckons grain output will have to rise by around half but meat output will have to double by 2050 to meet demand.

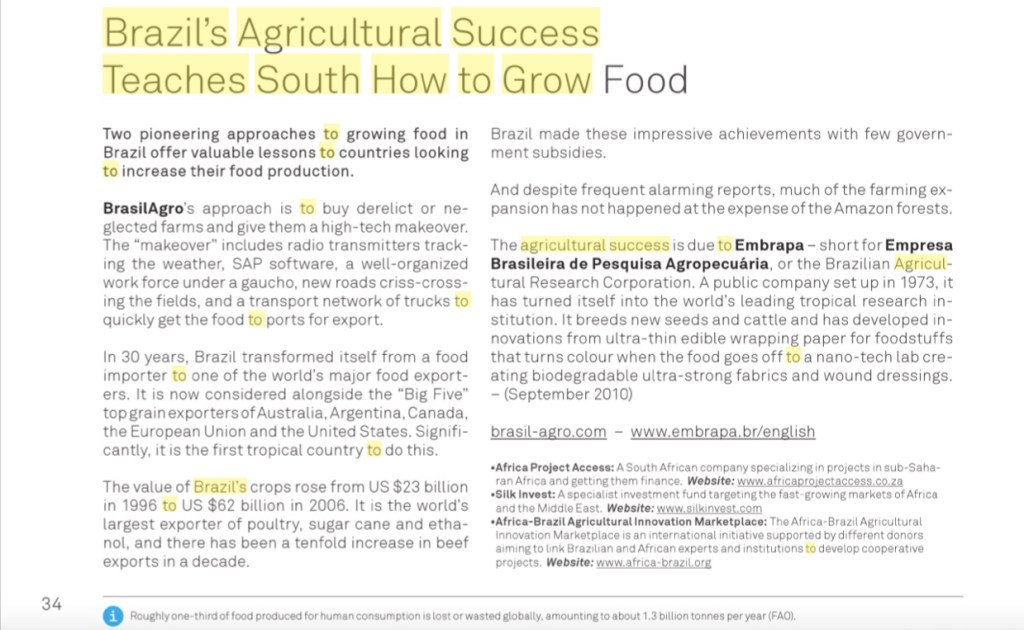

Two pioneering approaches to growing food in Brazil offer valuable lessons to countries looking to increase their food production.

One is taking place in Bahia state in north-eastern Brazil. On Brazil’s cerrado (savannah) (http://en.wikipedia.org/wiki/Cerrado), enormous farms grow cotton, soybeans and maize. One of them, Jatoba farm, has 24,000 hectares of land: vastly larger than comparable farms in the United States.

On the Cremaq farm in the north of the country in Piaui state, a transformation has taken place. Once a failed cashew farm, it is now a highly modern operation. Owned by BrasilAgro, it is benefiting from clever agricultural innovation that gets results.

BrasilAgro’s approach is to buy derelict or neglected farms and give them a high-tech makeover. The ‘makeover’ includes radio transmitters tracking the weather, SAP software (http://en.wikipedia.org/wiki/SAP_AG), a well-organized work force under a gaucho (http://en.wikipedia.org/wiki/Gaucho), new roads criss-crossing the fields, and a transport network of trucks to quickly get the food to ports for export. Piaui is an isolated place with few services: it can take half a day to get to a health clinic. Dependence on state welfare payments for survival is the norm for many residents.

Brazil, over 30 years, transformed itself from a food importer to one of the world’s major food exporters. It is now considered alongside the ‘Big Five’ top grain exporters of America, Canada, Australia, Argentina and the European Union. Importantly, it is the first tropical nation to do this.

The value of Brazil’s crops rose from US $23 billion in 1996, to US $62 bn in 2006. It is the world’s largest exporter of poultry, sugar cane and ethanol, and there has been a tenfold increase in beef exports in a decade.

Brazil made these impressive achievements with few government subsidies. According to the Organization for Economic Co-operation and Development (OECD), state support accounted for just 5.7 percent of total farm income in Brazil from 2005-07. In the US it was 12 percent, while the OECD average is 26 percent and the level in the European Union is 29 percent.

And despite frequent alarming reports, much of the farming expansion has not happened at the expense of the Amazon forests.

The agricultural success is down to Embrapa (http://www.embrapa.br/english) – short for Empresa Brasileira de Pesquisa Agropecuária, or the Brazilian Agricultural Research Corporation. A public company set up in 1973, it has turned itself into the world’s leading tropical research institution. It breeds new seeds and cattle and has developed innovations from ultra-thin edible wrapping paper for foodstuffs that turns colour when the food goes off to a nano-tech lab creating biodegradable ultra-strong fabrics and wound dressings.

Its biggest achievement has been turning the vast expanses of the cerrado green for agriculture. Norman Borlaug, an American plant scientist often called the father of the Green Revolution, told the New York Times that “nobody thought these soils were ever going to be productive.” They seemed too acidic and too poor in nutrients.

Embrapa uses what its scientists call a “system approach”: all the interventions work together. Improving the soil and developing new tropical soybeans were both needed for farming the cerrado. The two together also made possible the changes in farm techniques which have boosted yields further.

Many believe this approach can be applied to Africa as well. There are several reasons to think it can. Brazilian land is like Africa’s: tropical and nutrient-poor. The big difference is that the cerrado gets a decent amount of rain and most of Africa’s savannah does not (the exception is the swathe of southern Africa between Angola and Mozambique).

Another approach that Brazil has been pioneering is making small, family farms sustainable and productive for the 21st century.

There has long been a tension between those who believe in very large farms, agribusiness and mono-crops (http://en.wikipedia.org/wiki/Mono-cropping), and those who believe in having a large number of smaller farms with a wide variety of crops and animals.

But small farms have endured. The livelihoods of more than 2 billion people depend on the 450 million smallholder farms across the world. With their families, they account for a third of the world’s population.

Family farms are critical to weathering economic crises and ensuring a steady and secure food supply. The International Fund for Agricultural Development (IFAD) (www.ifad.org)called in 2008 for small family farms to be put at the heart of the global response to high food prices and uncertain food security.

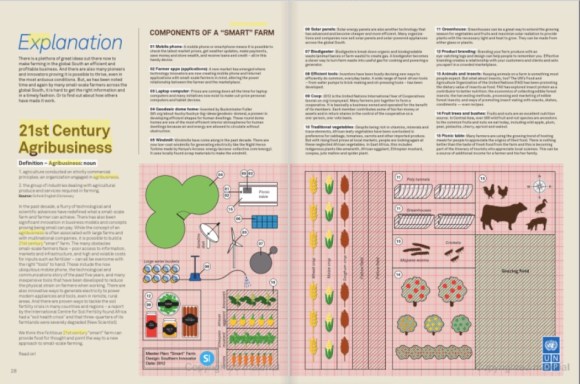

In Brazil, this call is being answered by a bold initiative to create what is termed a “social technology”, combining a house building programme with diverse family farms.

The Brazilian farmers’ cooperative Cooperhaf: Cooperativa de Habitacao dos Agricultores Familiares (http://www.cooperhaf.org.br) – a World Habitat Awards winner – combines housing and farm diversification to support family farmers.

“Family farming is very important for the country – 70 percent of food for Brazilians comes from family farming,” said Adriana Paola Paredes Penafiel, a projects adviser with the Cooperhaf. “The government wants to keep people in rural areas.”

“We see the house as the core issue,” she continued. “The farmers can improve their productivity but the starting point is the house.”

Started in 2001 by a federation of farmers unions, the Cooperhaf works in 14 Brazilian states with family farmers. In Brazil farmers have a right to a house in the law and the cooperative was formed to make sure this happened.

“We promote diversification to make farmers less vulnerable: if they lose a crop in macro farming, they lose everything. We encourage diversification and self-consumption to guarantee the family has food everyday. We help to set up a garden.”

The concept is simple: a good quality home acts as an anchor to the family farm, making them more productive as farmers. The farmers receive up to 6,000 reais (US $2,290) for a house, and can choose designs from a portfolio of options from the Cooperhaf.

As in other countries, the Cooperhaf and other co-ops encourage markets and certification programmes to promote family farmed food and raise awareness. Penafiel says promoting the fact that the food is family farmed is critical: to the consumer it is healthier, fresher and contains fewer chemicals than imported produce.

“Most agri business is for export,” said Penafiel. “If we don’t have food in the country, food for poor communities would not be available. This enables farmers to be more autonomous, not having to buy fertilizers and equipment and take on too much debt. That approach is not sustainable as we saw with the so-called Green Revolution.”

Published: September 2010

Resources

- Africa Project Access: A South African company specializing in projects in sub-Saharan Africa and getting them finance. Website:http://www.africaprojectaccess.co.za/

- Silk Invest: A specialist investment fund targeting the fast-growing markets of Africa and the Middle East. Website:http://www.silkinvest.com/

- Olam: A global food supply company in ‘agri-products’ that got its start in Nigeria and shows how a Southern brand can grow and go global and overcome the difficulties of cross-border trade. Website: www.olamonline.com

Development Challenges, South-South Solutions was launched as an e-newsletter in 2006 by UNDP’s South-South Cooperation Unit (now the United Nations Office for South-South Cooperation) based in New York, USA. It led on profiling the rise of the global South as an economic powerhouse and was one of the first regular publications to champion the global South’s innovators, entrepreneurs, and pioneers. It tracked the key trends that are now so profoundly reshaping how development is seen and done. This includes the rapid take-up of mobile phones and information technology in the global South (as profiled in the first issue of magazine Southern Innovator), the move to becoming a majority urban world, a growing global innovator culture, and the plethora of solutions being developed in the global South to tackle its problems and improve living conditions and boost human development. The success of the e-newsletter led to the launch of the magazine Southern Innovator.

This work is licensed under a

Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License.

ORCID iD: https://orcid.org/0000-0001-5311-1052.

© David South Consulting 2022

You must be logged in to post a comment.